Overseas Claims Experience Redesign for BCBSA

Blue Cross Blue Shield Federal Employee Program (BCBSA FEP), the largest federal health insurance provider with over 5 million members, was in need to quickly revamp their overseas claims experience after a market study pointed how their current process was burdened with complexity and inefficiency, leading to frustration among members and driving many to switch insurance providers. Key issues included disjointed steps, reliance on PDF documents, lack of field validations, and accessibility barriers. To address these challenges and enhance user satisfaction, we aimed to streamline the process, implement field validations, and ensure accessibility support.

Collaborative efforts with product managers and member usability sessions were instrumental in defining the scope for a first Minimum Viable Product (MVP) and gathering insights. Iterative design focused on improving clarity, consistency, and accessibility, resulted in a cohesive and user-friendly final design. Despite facing time constraints, our agile approach allowed us to deliver a viable MVP solution that met immediate needs while laying the groundwork for future enhancements.

After the MVP was launched we iterated introducing features such as personalization, dependent member claims filing, and draft saving capabilities. The most significant takeaway from this project was the importance of seamless digital experiences and serves as a reminder of the need for continuous innovation to meet evolving customer expectations in the digital age.

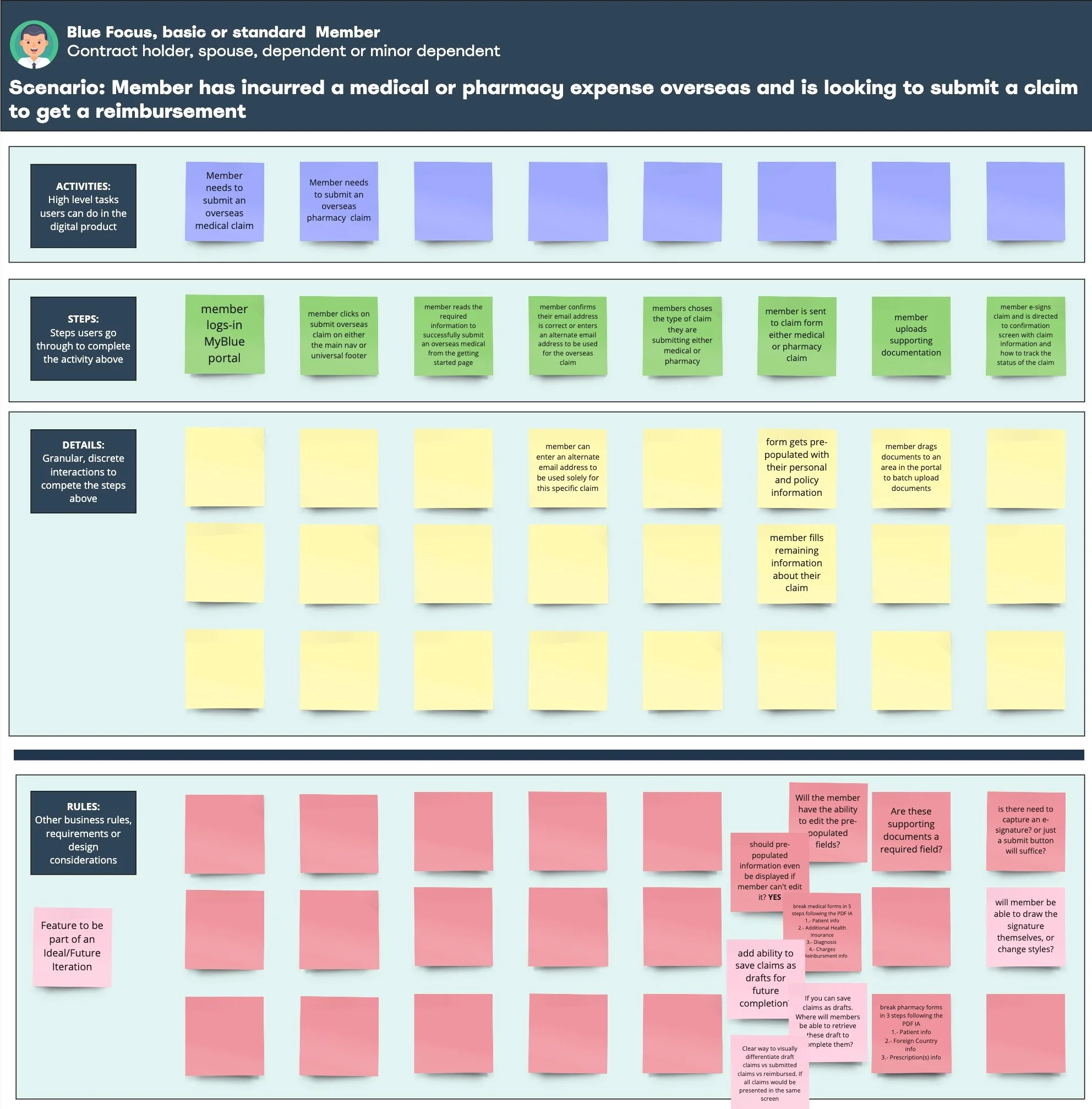

User story mapping exercise plotting tasks and activities member needed to perform on the redesigned experience

Process

Our main priority was to streamline the process and enhance user convenience. To achieve this, we began by crafting rough wireframes, breaking down the process into progressive, multiple-step digital forms for both medical and pharmacy claims.

Each digital form commenced with an initial screen listing all the requirements for successful completion, ensuring clarity from the outset. Subsequently, members were guided through screens to input their contact information and specify the type of claim they were submitting. Hereafter, distinct flows were designed for each claim type, with emphasis placed on highlighting required fields and providing intuitive warning messages until all necessary information was accurately filled in.

Once all steps and field types were defined, we transitioned to created a high-fidelity prototype leveraging the components within the design system to address accessibility and consistency issues while also serving as a platform for testing the proposed solution's usability with overseas members.

High definition functional prototype

Final Design

In crafting the final design, we optimized our efficiency by leveraging components exclusively from the pre-existing design system. This strategic approach not only ensured seamless cohesion with the existing portal but also significantly minimized development and quality assurance time.

By adhering to established design standards and utilizing pre-built components, we expedited the design process without sacrificing quality or consistency. This streamlined approach allowed us to focus our efforts on refining the user experience and implementing enhancements, rather than reinventing the wheel with custom design elements.

Furthermore, by aligning the new experience with the existing design system, we reinforced brand identity and maintained a unified visual language across the entire portal. This consistency not only enhances user familiarity and trust but also simplifies future maintenance and updates.

Ultimately, our judicious use of existing components not only expedited the design process but also ensured a cohesive and polished final product that seamlessly integrates with the broader portal ecosystem.

Annotated and specked final design prototype ready for handover to dev team

Next Steps & Lessons Learned

As previously mentioned, this iteration of the overseas claims submission system was developed as an NVP due to the time constraints we faced. While we incorporated several key feedback points gathered during member testing, as well as additional features that were considered but couldn't be included, we have already laid the groundwork for an enhanced version in the future.

One crucial aspect we're focusing on for the upcoming iteration is personalization. By understanding the information our client already possesses, we aim to pre-populate certain fields, thereby streamlining the submission process and reducing its overall length. Additionally, we're planning to introduce features such as the ability to file claims for dependent members, save partially completed claims as drafts, and provide a dashboard for tracking filed claims and managing drafts. Moreover, we're exploring the development of a completely native mobile experience, leveraging features like the built-in camera for seamless document upload.

The most significant takeaway from this project, both for us and our client, is the paramount importance of seamless and self-service digital experiences in today's landscape. The realization that a substantial number of overseas members were switching insurance providers due to the cumbersome claims filing process underscores the high expectations customers now have regarding digital interactions with organizations. This serves as a poignant reminder of the need for continuous improvement and innovation to meet and exceed customer expectations in an increasingly digital-centric world.